iowa city homestead tax credit

It is the property owners responsibility to apply for. Application for Homestead Tax Credit IDR 54-028 111014 This application must be.

Have you applied for your homestead tax credit.

. This rule is not applicable to a person owning a homestead dwelling pursuant to Iowa Code chapter 499B or a person owning a homestead dwelling on land owned by a community land. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the.

Iowa Tax Reform. Attention homeowners in Johnson County Iowa. That amount may then be reduced by.

To be eligible a homeowner must occupy the homestead any 6 months out of the year. 54-028a 090721 IOWA. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. It is the property owners responsibility to apply for. 54-028a 090721 IOWA.

Jackson County Assessor Office Application for Homestead Tax Credit Application for Homestead Tax Credit Iowa Code chapter 425 and. 54-028a 090721 IOWA. This application must be filed or postmarkedto your city or county.

This application must be filed or postmarkedto your city or county. To be eligible a homeowner must occupy the homestead any. Dubuque Street Iowa City IA 52240 Voice.

What is the Credit. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone.

Iowa City Assessor 913 S. 52240 The Homestead Credit is available to all homeowners who own and occupy the. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Brad Comer Assessor Marty Burkle Chief Deputy Assessor. This application must be filed or postmarkedto your city or county.

If you havent youre spending more than you need to on your p. What is the Credit. In 2021 the Iowa legislature passed SF 619.

Sioux City IA 51101 Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. Iowa law provides for a number of credits and exemptions. Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on.

The applicant must own and occupy the property on July 1 st of each year declare residency in Iowa for income tax purposes and occupy the property at least six months each year. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate.

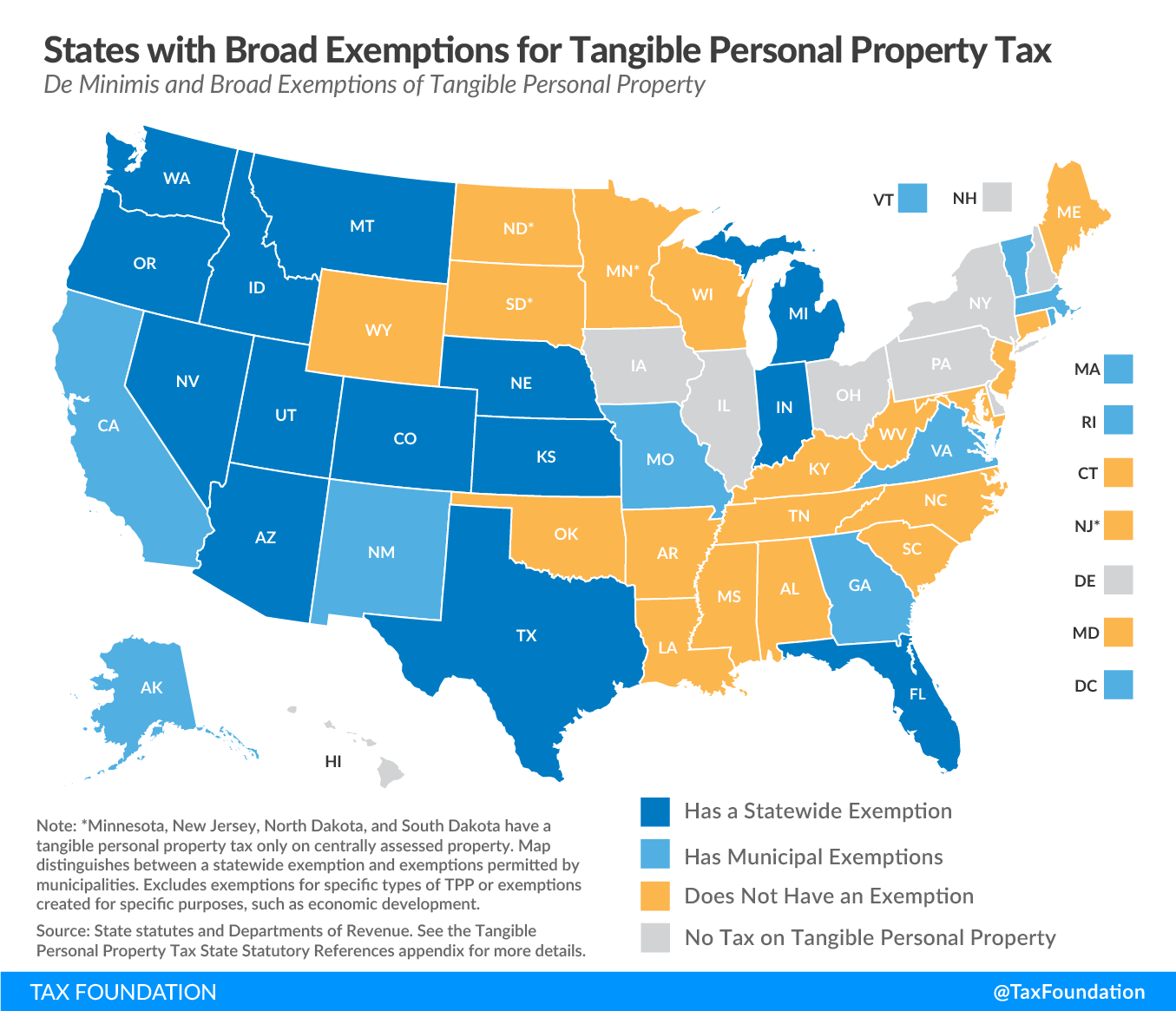

Tangible Personal Property State Tangible Personal Property Taxes

Historic Preservation Tax Credit Iowa Economic Development Authority

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Everything You Need To Know About The Solar Tax Credit

How And When To Apply For The Homestead Tax Credit In The Iowa City Area

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Iowa Tax Credit And Incentive Programs For Biotech Companies Ppt Download

State Tax Treatment Of Homestead And Non Homestead Residential Property

Tangible Personal Property State Tangible Personal Property Taxes

Military Veteran Families Work Life Resources

Iowa Property Tax Calculator Smartasset

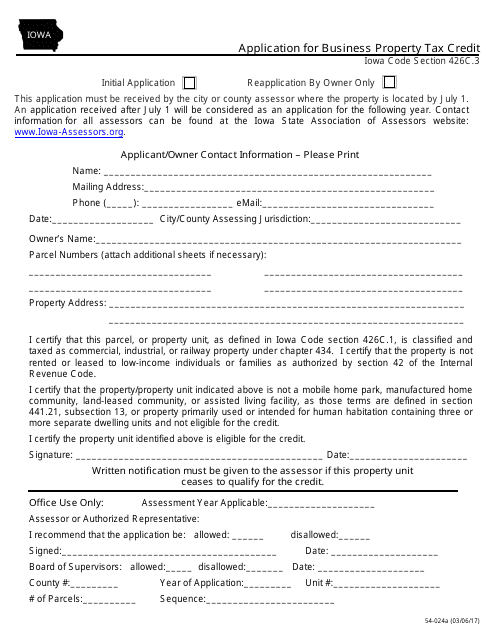

Form 54 024a Download Fillable Pdf Or Fill Online Application For Business Property Tax Credit Iowa Templateroller

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney